How To Develop FinTech App Like- MoneyLion, Chime, and Cash Apps?

Are you planning to launch a FinTech company? Or are you looking for the best FinTech startup ideas by developing your own app for the financial business?

The banking and finance app development industry is one of the fastest-growing industries globally as it offers high-level security and convenience over traditional forms of financial services.

Initially, FinTech was limited to bank operations and some trading only. But the introduction of AI, Machine Learning, Big Data, and Blockchain technology have revolutionized the entire FinTech industry.

Today FinTech apps are widely used by people across the world for transferring money to investing in stocks.

Here, we will guide you to execute your ideas properly in developing custom fintech software development for your business.

Why Should You Develop a Fintech App?

Today, FinTech apps are the need of people to manage their accounts, invest in the market, and for other banking operations.

FinTech apps like- MoneyLion, Chime, and Cash App are raising money and attracting investors to invest in their businesses to engage and attract more customers.

Today’s generation of people is more aware of FinTech apps. They are making online transactions like never before.

In the USA, the number of users in the digital payment segment is expected to amount to 320.22m by 2027.

This signifies that there is an excellent growth of mobile-only banks and digital payment method services across the globe.

Let’s see some of the statics that proves that there is a vast market approach for the FinTech App in this digital transaction world.

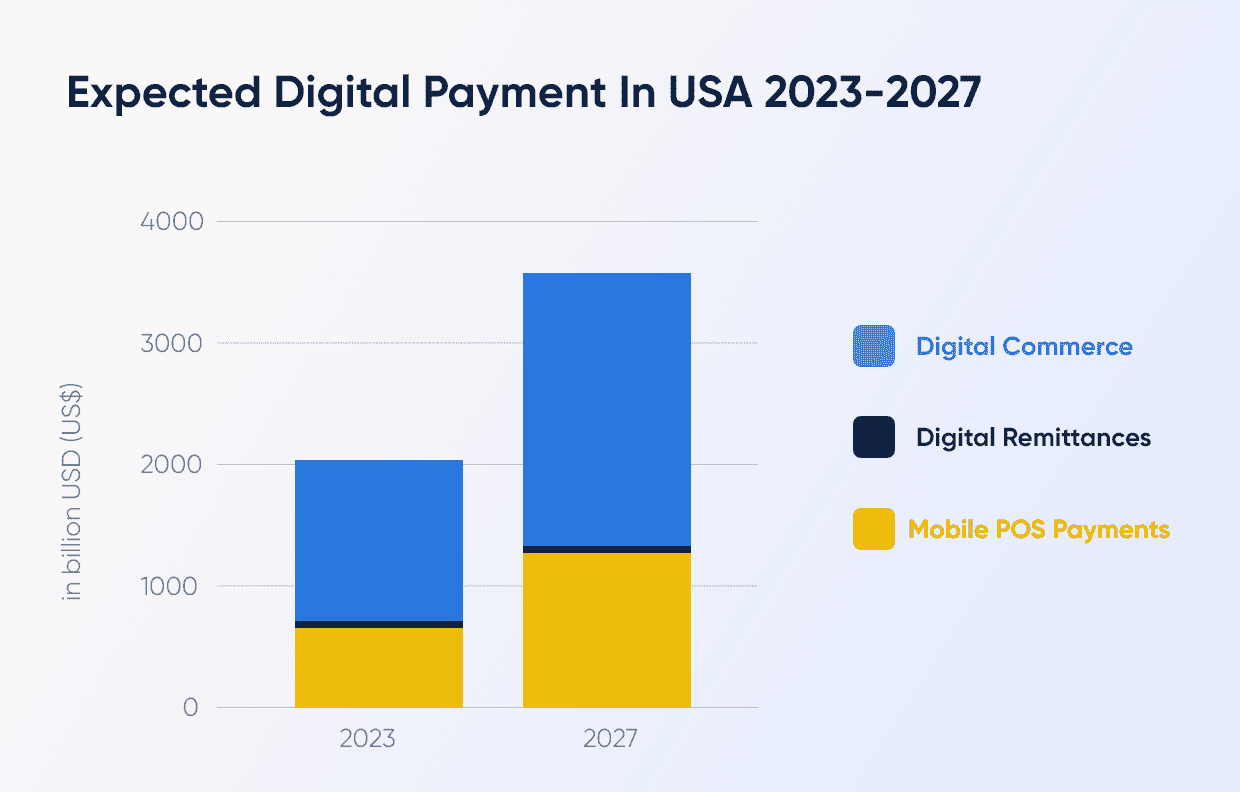

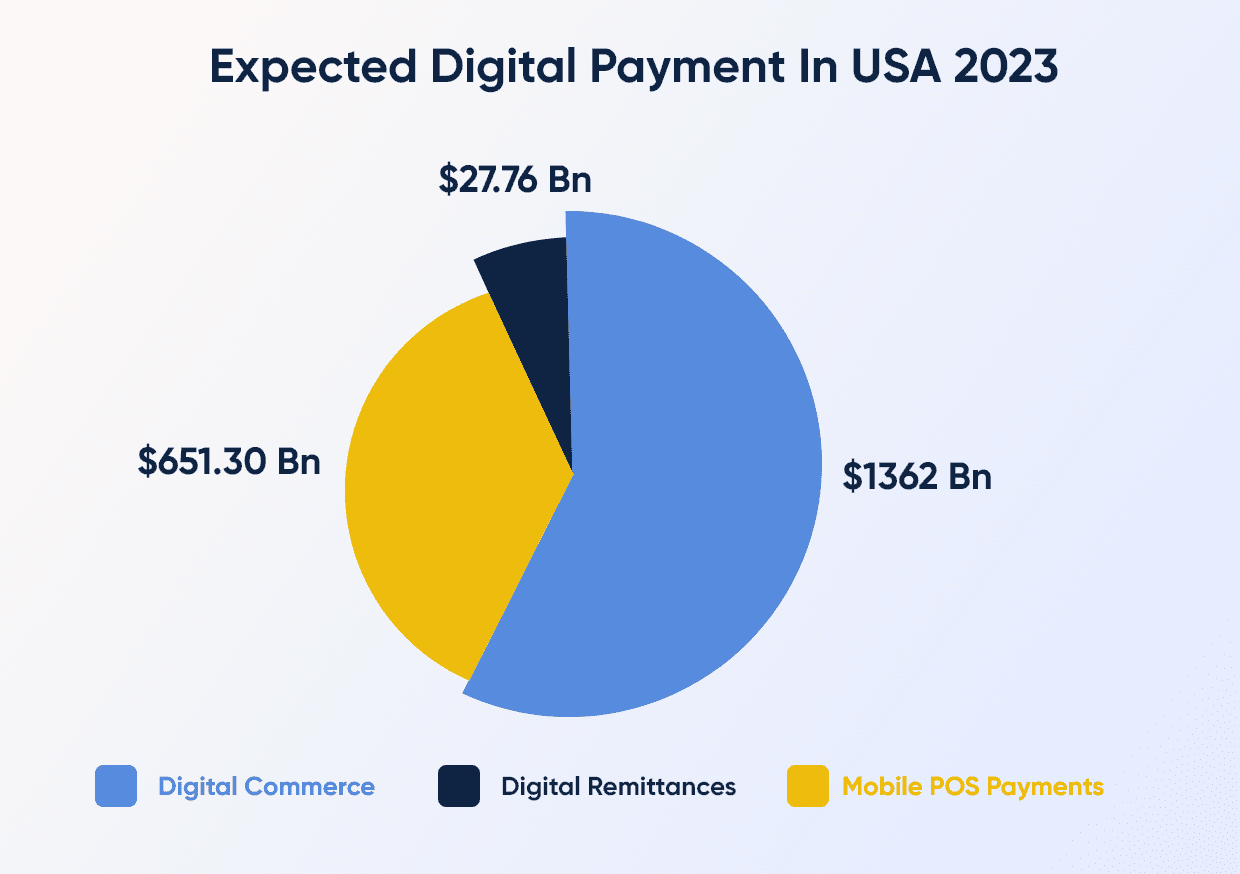

- Digital Payments are the new norm, and it is expected to have a total transaction value of US$2,041.00bn in 2023.

- The market’s largest segment will be Digital Payments with a total transaction value of US$9,683.00bn in 2023.

- The Neo banking segment is expected to show a revenue growth of 25.2% in 2024.

Expected $2041Bn Digital Payments Transaction Value in 2023

Now, let’s see the popular FinTech apps that are doing exceptionally well in the market and helping people in achieving their goals.

Read More: How Much Does It Cost to Build Personal Finance App Like- EveryDollar App?

Some of the Popular FinTech Apps in the USA

MoneyLion

MoneyLion is a mobile app that was rolled out in 2013. The app is the most popular in the USA which provides its users with financial advice and access to loans.

It provides various financial needs of the users and provides them access to loans. They generate revenue through subscription-based service at the cost of $19.99 per month from their users by providing them with premium banking solutions and advanced cash facilities.

Chime

Chime is another financial technology company that can be an alternative to traditional banking and is growing as a mobile-only bank.

It offers a simple and easy-to-understand interface to customers in managing their spending and saving accounts with no hidden transaction fees.

Its large free ATM network of over 30,000 fee-free money passes provides efficient online banking services and makes it one of the most convenient FinTech banking apps across the country.

Cash App

Launched by Block Inc in 2015, Cash App is a web-based finance mobile application designed to help businesses send money.

Cash apps allow individuals, organizations, and business owners to create a unique username to send and receive money, invest in cryptocurrencies, and trade in stocks.

Cash app is the #1 ranking in the USA in the FinTech category and has the greatest number of users.

Features To Implement in Your FinTech App?

Secured Sign In

The first and most important feature of any FinTech app is the secure login gateways. Security decides the fate of your FinTech app and plays an important role in protecting their valuable information and transactions.

Secure login through unique code generation, facial identification, fingertip recognition, and one-time password protection are the best way to implement a secure sign-in option.

Personalization

The introduction of AI and Machine Learning in your app allows you to target users more efficiently.

Deliver them a personalized user interface and provide relevant inputs about new updates, policies, and benefits.

Providing significant inputs and recommendations helps in client retention and brings more audiences.

Live Spending Tracking and History

Today’s Fintech apps are smarter than ever. It allows their users to keep track of their spending and shows them their live spending on stocks and other transactions.

Thus, users can limit their spending and can manage their transactions. This helps your users to save time and limit their expenses.

Push Notification

Push notifications allow you to engage the audience through special offers and discounts on transactions.

You can also send them updates on their finances as well as finance industry news to bring maximum engagement of users to your app. This increases the credibility and growth of your app.

Budget Analysis

Providing budget analysis and organizing all the user expenses within your FinTech app helps them to organize the actual finance spending they have in a month or a year.

Thus, they can manage their budget or cut their expenses with some alternatives.

How To Develop Your FinTech App?

Building your Fintech app takes a lot of processes like- planning, conceptualizing, and executing the basic structural arrangements of your premium app development.

Thus, it becomes crucial to ensure that the development process is carried out correctly.

Determine Your Target Audience

Before developing your FinTech app, it becomes essential for you to determine the target audience. Look for the audiences and how much they make online transactions and use other apps for the transaction.

Having a clear concept about the app and the features they want to use within the app matters a lot in the overall success of your app.

Implement The Best Features

Now, it’s time to implement the best features in your FinTech app. You can choose the best feature of your app by knowing the demand of your target audience and looking for other competitors.

Don’t overload your app with tons of features and decide on features for your fintech app.

Read More: Top 6 Challenges of Financial Services Industry – Banking, Insurance & Retail

Hire The Best App Development Company

Choosing the right fintech mobile app development services company is the most crucial step for developing the FinTech app.

Look for a software company that has experience in ensuring high-quality app development. They must have a team of professionals and experts so that you save both time and money in the overall app development process.

How Much Will It Cost to Develop an App?

Determining the budget and overall fintech app development cost of your app helps you in deciding on the app development.

Several features of your app development help you in determining the cost of app development. However, Budget constraints matter a lot in the overall app development and can slow down the process.

Estimating the overall amount can help you in investing for future-proof app development.

Have a Finance App Idea? Clavax Can Help You in Building Future-Proof FinTech Apps

If you are planning to be the next “FinTech future” app for Gen Z, then it will be better to build a plan according to your business needs and get the budget for your app development.

We at Clavax technology are the best fintech mobile app development services company that can help you in building FinTech apps.

We have decades of experience in building various apps for different businesses and startups. Our team of expert professionals in developing your own finance mobile application solutions. Connect with us today!