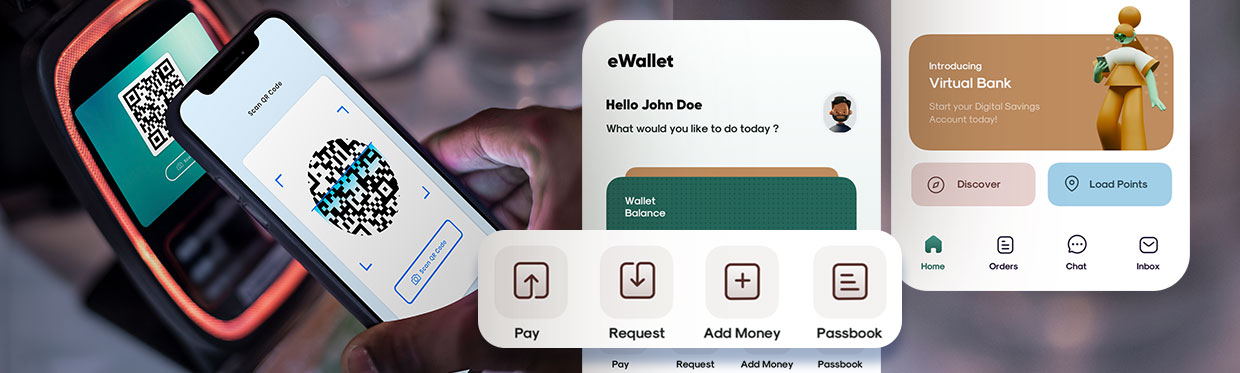

Things to Know About eWallet Mobile App Development– Key Features & Cost

With the rise in digitization over the years, cashless payments are gaining huge attention. The pandemic outbreak led to an increasing preference for mobile apps to make online payments. People no longer rely on cash for the purchase of products or exchange goods. With the introduction of eWallet mobile apps, many business owners are relying on mobile app development companies to build custom apps to buy/sell products.

Whether it’s grocery shopping or ticking booking, customers want to make payment using digital cash on their eWallets. Undoubtedly, the evolution of digital mobile wallet applications has provided a better & faster online transaction experience. Let’s find out how eWallet mobile app development services will help your business grow and everything you need to know about it!

Reasons to Invest in eWallet Mobile App Development

Making digital payments with utmost ease is what every customer looks for when they purchase from a brand. Not integrating a digital payment system in your business can be a disadvantage as it can make your customers lose interest. More and more digital payment applications are gaining huge attention that facilitates touchless transactions in businesses.

Here are some of the main benefits that eWallet Mobile App Development can offer to your business-

-

Increase in Conversion Rate

No long waiting hours just to pay bills! Let your customer pay them instantly using a mobile payment app that can help increase your products sales. A better payment approach will eventually help increase their buying behavior and bring more revenue.

How much to create ewallet mobile app

-

Lower Chance of Abandoned Carts

One of the biggest drawbacks that hold back businesses from growing is the high number of abandoned carts. The introduction of e-wallets helps in reducing the number of abandoned carts and speeds up the buying process, as it offers more ease and convenience.

-

Low Transaction Charges

Many mobile commerce platforms have lower transaction fees as compared to the high-interest rates of credit cards. They can also offer value-added payment card that makes customer easy to make payment without any involvement from the bank, thereby reducing transaction fee.

-

Refunds

Order returns are made easy with mobile payment apps as customers can get quick refunds in the form of ready-to-use cash directly on their app that can be used on future purchases. Also, business owners can retarget for more sales with customized offerings & discounts.

-

Larger Customer Base

A well-developed contactless payment app can be a great benefit to both business owners as well as customers. People nowadays prefer a secure payment medium aligned with high-security features, which is why; you can gain a higher customer base with such apps.

Read More: 7 Digital Banking Transformation Trends For 2023

Top Must-Have Features for eWallet Mobile App

If you are planning to build an e-wallet mobile app, here are a few things that must be kept in mind before the development of the app.

-

Security

The payment app needs robust security standards and policies that must be incorporated as users will store their sensitive banking information for making transactions. Hire a development team that is well aware of industry-leading technologies and stringent security mechanisms that are difficult to decrypt.

-

Online Receipt

Ensure that your app is integrated with a digital receipt system that enables users to get confirmation status after every online transaction. The receipt should be sent to the user’s mobile number or email address.

-

Compliance

The mCommerce platforms must comply with the local and global banking laws and regulations, which is why the e-wallet mobile app should be developed in such a way that it avoids any risks and ensure transparency in transactions.

User Features

- Register via Social Media Account & Log In

- Add & Authorize Bank Account

- Send /Accept Money

- View Balance & Transaction History

- Pay Bills/Set AutoPay

- Budget management

- POS Integration

- Send invites for referral points

Merchant Features

- Log in and create/edit profile

- Add/manage products

- Create QR codes

- Manage Customer Records & employees

- Add promotional discounts

- Provide loyalty points & rewards

- Offer EMI payment options

- Push notifications

Admin Features

- Log in

- Manage Users & Merchants

- Add New Offers

- Real-Time Analytics

- Ensure Security

- Revenue Management

- Users data control

- Reporting & Auditing

Read More: How To Develop FinTech App Like- MoneyLion, Chime, and Cash Apps?

How Much Does It Cost To Build an e-Wallet Mobile App?

Finding out the exact app development cost would be difficult as it depends on various factors such as app design, features complexity, technology, app platform you choose, etc. The cost of building a basic e-wallet mobile app may cost between $25k to $50k while an advanced app with more features will cost around $90k to $150k and even more. Additionally, the pricing also depends on hourly development rates charged by developers at different locations.

Final Thoughts

As we can see the development of e-Wallet mobile apps has completely changed the nature of the money transfer and provided several benefits to many businesses, it’s time that you build your wallet app for your business. However, ensure that you keep security on top priority to help your customers transact safely. Research says 98.5% of payments are done through e-wallet apps from the year 2020 to 2021. If you are planning to build one, get in touch with our expert e-wallet app developers and offer a safe transaction facility to your customers.